Weekly Crypto & Markets Roundup: 09/12

FTX smells blood in the water as Voyager assets are going to auction this week, Ethereum merge details, MKR token valuation insanity, BUSD world domination & more!

Hello and welcome!

I had a fun IRL weekend, so this is coming a little later than usual. Big things to watch for this week (I probably missed something btw). Regarding crypto, there is only the $ETH merge on the schedule for this week so I will isolate it in case you just came for that.

The Ethereum Merge On Sept 15th at 1:14am ET

As we enter this trading week, remember one of my favorite trading sayings:

Do you want to be right or do you want to make money?

TOP STORIES

Voyager Digital To Auction Assets Sept 13th

Rumors are that Binance and FTX are in the buyer pool but no specific list yet of the total of 22 parties in active talks. This is another step in the Voyager restructuring plan. The court hearing will approve the results of the auction on Sept 29th. We will find out tomorrow (09/13)

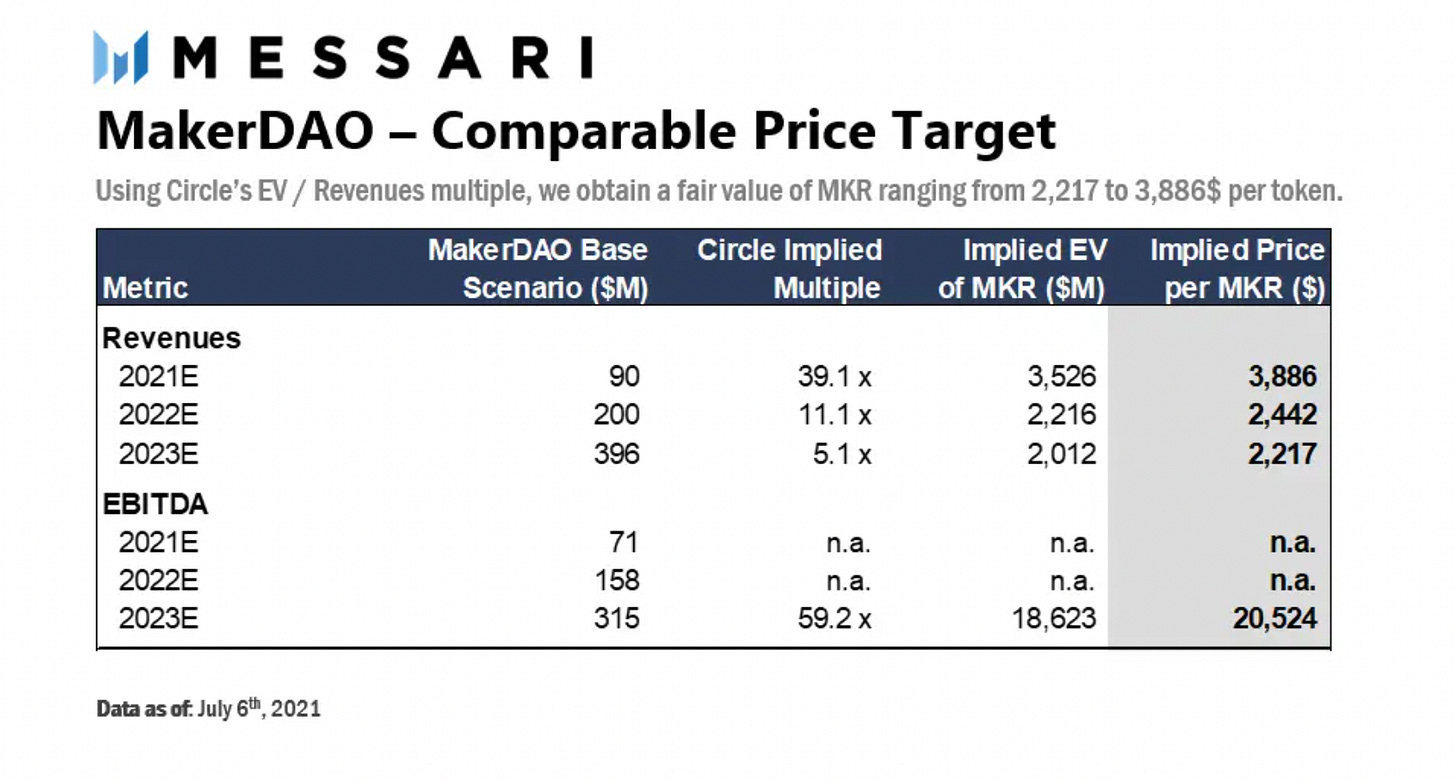

How Would You Value $MKR?

I saw recently on Twitter that Messari has a valuation of the $MKR token and it is pretty fricken ludicrous. In a few images below they value the fair market value at anywhere between $2,300-$6,800 per coin. See below for madness.

Looking at Makers’ books as if they were a traditional company seems weird to me and I think the valuation shows just how much Kool-Aid boomers with Google can drink. Here is the original Messari report if you are interested.

Binance & BUSD

Binance has updated the way they manage your stablecoins and it is very skewed towards their own benefit…of course. If you hold USDC, USDP or TUSD you will be opt-in on Sept. 29th. The “why” is yield from USDT / USDC without Circle or Tether making any money from the underlying dollars actually deposited.

Binance Auto-Convert Announcement

Jeremy from Circle reaction to the announcement

Alt L1 Rotatooors Meet Cosmos

This basically describes my current sentiment on why I believe $ATOM is holding up strong in these market conditions. Shoutout to NoSleepJon

OUTSIDE OF CRYPTO

China’s Exports Declining + Imports Rising

China is selling US Treasuries and is running out of liquid USD. This is something I am not going to macro larp about, but this does seem important so looking into it more.

On the contrary, the “official” numbers are out and they are showing better numbers in Annual CPI (2.5%) and Annual PPI (+2.3%) and a flat-out negative Monthly CPI (-0.1%) number when the previous monthly increase was 0.5%.

Meta Executives Will Not Be Testifying

META 0.00%↑ settled just before Mark and Sheryl would have had to testify under oath. The below tweet describes what they were expected to enduring the courtroom if they did hit the stand. Call me a betting man, but that seems a little intentional. One of the quotes from the Gizmodo article said about Zuck that he was “desperate to avoid being questioned,”

EVENT CALENDAR THIS WEEK

Tuesday - 09/13

U.S. (CPI) MoM & YoY - 8:30am ET -

Federal Budget Balance - 2:00pm ET - this is the meat and potatoes for the week as this is where we see if we are on track for the same interest rate hikes (0.75) or if we are going to increase to a higher number. Also, something to watch is the tone in which Jerome Powell is speaking in this meeting. At Jackson Hall, he was very firm in the way he described how everyday people would feel more pain until it got better.

Wednesday - 09/14

U.S. Crude Oil Inventory - 7:30am ET - I am curious to know where the reserves are after Joe Biden has been releasing oil from reserves to bring down the price of gas. This was a tactic used to show the American people lower gas prices before the midterm elections but it was a temporary fix, and the supply cannot be replaced with him just asking nicely.

U.S. Producer Price Index (PPI) MoM - 8:30am ET

U.K. CPI MoM & YoY - 2:00am ET

Thursday - 09/15

U.S. Jobless Claims - 8:30am ET - this is important because this is the other end of the equation for Jerome Powell. Having a tight labor market means that unemployment is low. Unemployment cannot be low while inflation rises.

U.S. Retail Sales MoM - 8:30am ET

U.S. Philadelphia Fed Manufacturing Index - 8:30am ET

Friday - 09/16

Eurozone CPI MoM & YoY - 5am ET - This is only important to show comparatively how other countries are faring due to the United States.

Catch all the updates live on my Twitter (@0x_brandon)