Weekly Roundup: 09/05

Token catalyst dates are incoming soon, Saylor is sued by Washington DC, FedBase releases cbETH with built-in blacklisting, and more!

Keeping it short this week because the market chop has been very crazy but this is a roundup of all the events from the week minus market critique. I want to stay away from charts on here and focus on just news updates, catalysts, and big wallet watching as a way to track the web3 space as a whole. I am thoroughly interested in the space, and I am glad to share it with whoever may read 🙂

Token Catalysts

Multiple token catalysts for the month, wrapped up so cleanly by Tolks and the Page One team. Please go follow them because Tolks did all this work and I am just sharing it for your convenience in case you have not seen it!

Full list:

Tokens included that caught my eye + the reasoning included:

$GMX $DPX $BTRFLY $.SNX - I always like hedging my own degen trades with protocols that bring in actual revenue. Staking and HODLing are different depending on the protocol but look into these if you are looking for some long-term tokens.

$XMON - Limited supply, easily pump-able and crypto twitter gets YFI 2.0 vibes from the high token price.

$FXS - stablecoin? lolz I wonder if this is due to technical reasoning or due to the backing and conservative nature of the project after LUNA collapse.

$YFI - Defi protocol with revenue, real-world usage, institutional investors and decentralized team (+ Banteg is bae) YFI is also focused on being the backend to others’ frontend. This ability to be behind the scenes and involved in so many projects can be a serious help for the token sells Saas narrative.

$ARBI - potential Arbitrum network coin - what will it do? why coin?

$CHZ - Fan coins are an actual real-world use case, and I love the enthusiasm behind the CHZ team. They have the partnerships in place with Binance so many news releases and updates are coming in the works (whether real or fluffed up)

$LINK - are the marines still around? Curious to see what LINK can do to bring in real-world usage and start selling services to businesses no matter if they are crypto or not, real-world revenue.

Saylor Sued

Michael Saylor is being sued by Washington DC for not paying taxes. This seems like a weird case of them catching him slipping on podcast interviews, and he confirmed a few details that helped their case. Looking forward to seeing how this will work though and what the DC District Attorney is even looking to achieve. If I have time this week, I will look further into the Michael Saylor lawsuit and start pulling out some good parts on this Twitter thread.

Liquidity & $LUSD

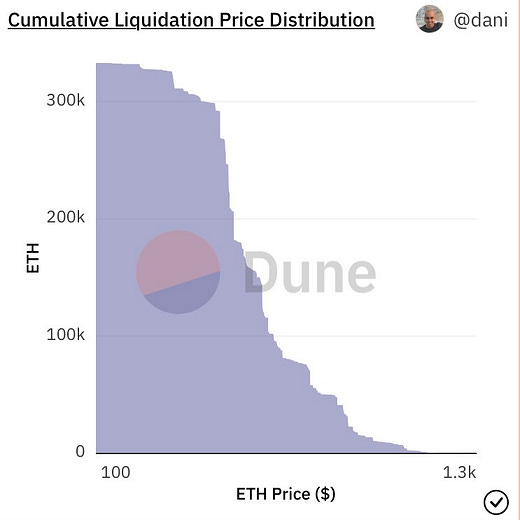

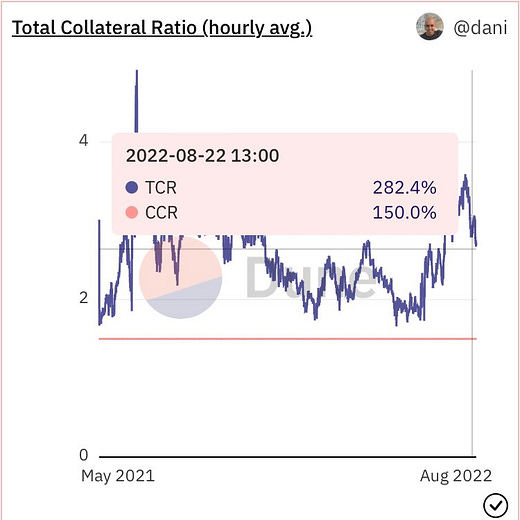

$LUSD - Liquidity currently has over $500M+ in TVL and is full of very conservative borrowers. This really illustrates the PTSD people have from LUNA and the uncertainty in the air with other stables. With borrowers being this conservative, the 0% interest rate loans provide a balance between supply and demand while making the major liquidation point at $900ish. But this also raises questions like why FXS or LUSD? Curious to look into this more with a stablecoin guide for 2022.

USD Has ShitCoin Tokenomics

Putting USD tokenomics into altcoin terms will break your brain. All you have to know is that the US has cheat codes and acts as the banker in monopoly. They can do what they want because the game everyone else plays is different than what the US plays. It is not a chess or checkers relationship but more like a chess and chess piece + board manufacturer with the US being the ladder.

Traders Need Statistics

Key stats to keep as a top-tier trader, or a pepper. Salsa always has the best advice and finds ways to make it sound more understandable for left-curve brains. I would also recommend using a private ONLY YOU discord server to be your trading log because it is free and VERY versatile.

NFT Scams To Watch Out For: @NFTherder

13 NFT scams you should be aware of by OKHOTSHOT. Go give him a follow because he hosts weekly spaces that are incredible, and he is the real deal when it comes to NFT contract details, security audits, and more. Phishing is a very common attack vector, but there are so many ways to trick uninformed users in web3 that I would just check the list and make sure you understand all 13 scams, so you are more prepared for the future.

FedBase Staked ETH Edition

Coinbase releases their own version of a staked Ethereum token to make liquid staked positions in the for of cbETH. Similar to Lido’s stETH but cbETH has built-in blacklisting like USDC. So they can cut off your assets and blacklist them making you unable to do anything. Of course, this is the case because Coinbase is a publicly traded company so they will always build in the option to do these crazy control features so that when the government asks them to flip the switch on they can stay in good graces and say yes sir.

Interview With Pentoshi

The legend Pentoshi is meeting the young legend Will Clemente. I have been following Pentoshi for a few years on a few different accounts. The content and alpha Pentosh puts out is always consistent, and it is great to see Will Clemente always raising the bar when it comes to content.

https://wclementeiii.medium.com/pentoshi-interview-eefe28edd503

Builders Will Continue To Build

LlamaPay is a good case study of a true web3 business that is low cost and lean AF. Here is a thread from the main llama himself and I will say that I can confirm they keep the team tight. I asked if they were hiring before I started working at CT and I am not enough dev and too much marketer. Respect though and always watching the innovative teams no matter what.

Goal For My Substack

Brief yet valuable knowledge.

Where I got this from: @AviFelman

Outside Of Crypto

Global Manufacturing Is Drying Up Again

Drought is hitting China hard and will definitely hurt manufacturing as cities are limiting power usage. The above is a photo from the Yangtze river, and as the rivers dry up from drought, they will significantly hurt China’s mainly hydro-powered manufacturing hubs. - Video

Laying Flat In China

Chinese business owners are losing motivation and also “laying flat / letting rot” - Video

Energy Is The Trade Going Into Winter

Germany hasn’t solidified where it will get its energy in the winter.

Americans LOVE Debt

This video went viral on crypto Twitter and it was funny to see the reactions of the world laughing at the United States. So much wealth, so much debt and so much unhealthy financial habits. Gotta love it but in all seriousness take a note from this video and audit your own expenses. Is there anything you would be embarrassed to tell people because it’s so expensive?

That is all folks but come back later this week for more content and make sure to tell your crypto-interested friends to follow this free newsletter! For live news updates during this week, catch me on Twitter.