Tokenization: The Future of Asset Ownership or a Fleeting Trend?

The incorporation of real-world assets into the blockchain is reshaping the landscape of global finance. Innovating with blockchain brings challenges: how will issuers address security and compliance?

Quick Summary:

Tokenization of Assets: Transforming real-world assets into digital tokens for efficient, 24/7 blockchain trading.

Diverse Asset Inclusion: Extends to real estate, fine art, bonds, currencies, and stocks with an estimated market potential of up to $16 trillion by 2030.

Streamlined Investment: Reduces costs and barriers to entry, democratizing access to investment opportunities.

Compliance and Security: Critical focus on regulatory navigation, secure identity verification (KYC/AML), and robust protection against cyber threats.

Industry Transformation: Attracts attention from financial heavyweights, signaling a shift towards more transparent and accessible asset management.

The Token Economy: A Disruption in Asset Management

Asset tokenization is not just a fad, it’s a revolution in the making. Think of it as the alchemy of finance, where traditional assets from real estate to fine art are being transformed into digital gold, tradable 24/7 on blockchain platforms.

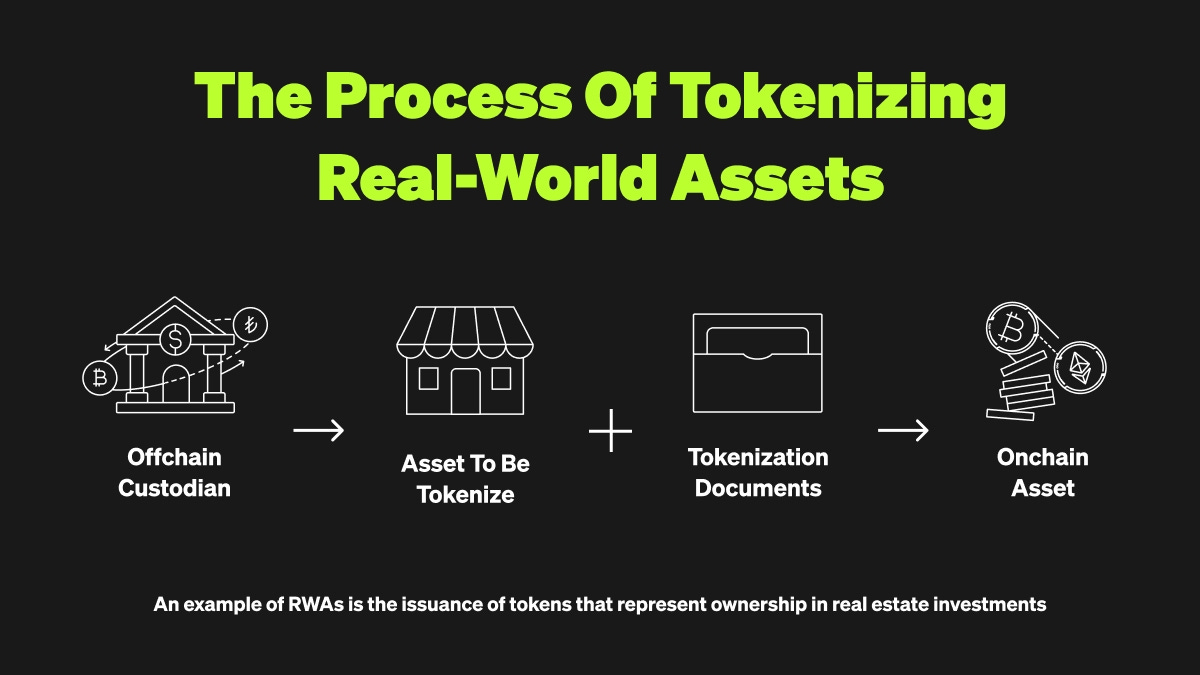

Tokenization Explained

At its core, tokenization is the process of converting rights to an asset into a digital token on a blockchain. Forget the dusty paper deeds and certificates; ownership is now at the forefront of digital innovation. Let’s explore the example of tokenizing a real estate property or a Picasso painting…

Consider ownership of a Picasso or an office building divided into 1,000 tokens; these tokens can change hands in a heartbeat, sans the red tape. It’s a lean, mean trading machine that operates with the simplicity and speed of an internet connection. Fractional ownership makes assets more liquid and markets more accessible for all investors.

The thesis is similar to Robinhood and fractional share ownership of equities. If you offer smaller pieces of expensive assets then more people can get involved making it a win win for all parties.

The Allure of Tokenization

What’s the big deal? Efficiency and accessibility. By eliminating intermediaries, we cut transactional chaff, allowing for sleeker, cost-effective trades. The blockchain doesn’t care for office hours; it’s an insomniac’s market out there. And with lower barriers to entry, the everyday Joe and Jane can play in what was once a billionaires’ sandbox.

Not Just for the Crypto Cognoscenti

Beyond the niche world of art and collectibles, tokenization is permeating traditional bastions of wealth: bonds, currencies, stocks. It’s a sign that the blockchain is not just disrupting; it’s reconstructing the very landscape of asset trading.

Why Finance Moguls are Taking Notes

Titans like Larry Fink are circling in on tokenized securities as a way to improve TradFi. He may have stepped on a few toes with ESG, but his interest in tokenization is telling. This quite was back from the end of 2022 and the fixation with tokenized securities has only gotten more intense.

Market Potential? It’s Sky-High

We’re looking at a token market potentially hitting $16 trillion within the decade. That’s trillion with a ‘T’ - a significant slice of the global asset pie. The market is scaling up dramatically, currently at $6 billion+ according to DeFiLlama:

The Hurdles on the Track

Yet, it’s not without hurdles. The regulatory landscape is a labyrinth, demanding a legal eagle’s eye to navigate. Tokens need legal weight to matter, and the rules of the game are still being written.

KYC: The Gatekeeper’s Dilemma

Identity verification is another beast. In the anonymous world of blockchain, ensuring clean trades requires innovation - think digital identity solutions like a KYC NFT passport.

Price Tags in the Digital Era

Valuation is another cornerstone - investors need to know the token is worth its digital weight in gold. This calls for established valuation frameworks and reliable data feeds to anchor prices in reality.

Security: The Achilles' Heel

Blockchain is robust, but no fortress is impenetrable. The technology faces its own set of Achilles’ heels, from smart contract flaws to cybersecurity breaches. Vigilance and rigorous security protocols are non-negotiable.

Conclusion

Tokenization is redefining asset management, promising inclusivity and efficiency. But with great power comes great responsibility: the ecosystem demands maturity, from solid regulatory compliance to foolproof security. It’s a brave new world of asset management - complex, yes, but also undeniably compelling.

So, are we witnessing the democratization of asset investment, or just another buzzword-laden bubble? Let's wait and see…