Debt Dispute at DCG: Potential Shockwaves in the Crypto Market or FUD?

A analysis of the ongoing debt restructuring at Digital Currency Group and discussing default consequences to market confidence and working relationships from crypto to traditional finance.

Updates: As of Wednesday (05/17) there are no updates from DCG or partners.

Getting Up To Speed

As of May 9th, the situation remains uncertain, with DCG and Genesis in disagreement over the nature of the debt and the terms of the mediation. Notably, DCG is seeking to refinance intercompany loans, while the UCC has expressed mistrust and a desire for a new deal.

Digital Currency Group (DCG) is currently engaged in a restructuring process with Genesis Capital, participating in a mutual 30-day mediation period that began on May 1st. Concurrently, DCG is negotiating with potential investors to secure growth capital and refinance its existing debt with Genesis. DCG is committed to reaching a mutually beneficial resolution during this mediation period.

Perspective Is Key

From the outside looking in, DCG's leader Barry Silbert has been notably quiet during these negotiations, which doesn't inspire confidence. This was Barry’s last snarky reply (on 04/29) just like the good ol’ days:

The most recent update from DCG states that they are looking to restructure the debt and will have updates soon. As of Sat 05/13, no updates yet but I assume the restructuring teams are working overtime this weekend.

Potential Impact on Crypto Markets

This development has the potential to deliver a substantial blow to market confidence, signaling another failure in the intersection of crypto and traditional finance. Panic selling is likely, particularly due to uncertainty around GBTC holdings. Only time will tell how much the markets will drop or how they will react but we can compare that to other events IF it happens. The magnitude of DCG's influence in the crypto ecosystem means this situation could have far-reaching effects on their subsidiaries like Grayscale, Coindesk & Luno.

Players to watch from this story:

Genesis Trading Desk’s Twitter

Crypto Lawyer Ram Ahluwalia’s Twitter

DCG Background

DCG is a venture capital firm focusing on the digital currency market, founded by Barry Silbert in 2015. With five subsidiaries, including Genesis, Grayscale Investments, and CoinDesk, DCG has a significant footprint in the crypto ecosystem. Genesis Global Capital, the DCG subsidiary at the center of this crisis, provides cryptocurrency trading, lending, and asset custody to institutional clients. Unfortunately, significant financial issues led to Genesis filing for Chapter 11 bankruptcy protection in 2023. This event further destabilized DCG's balance sheet and has led to the present crisis.

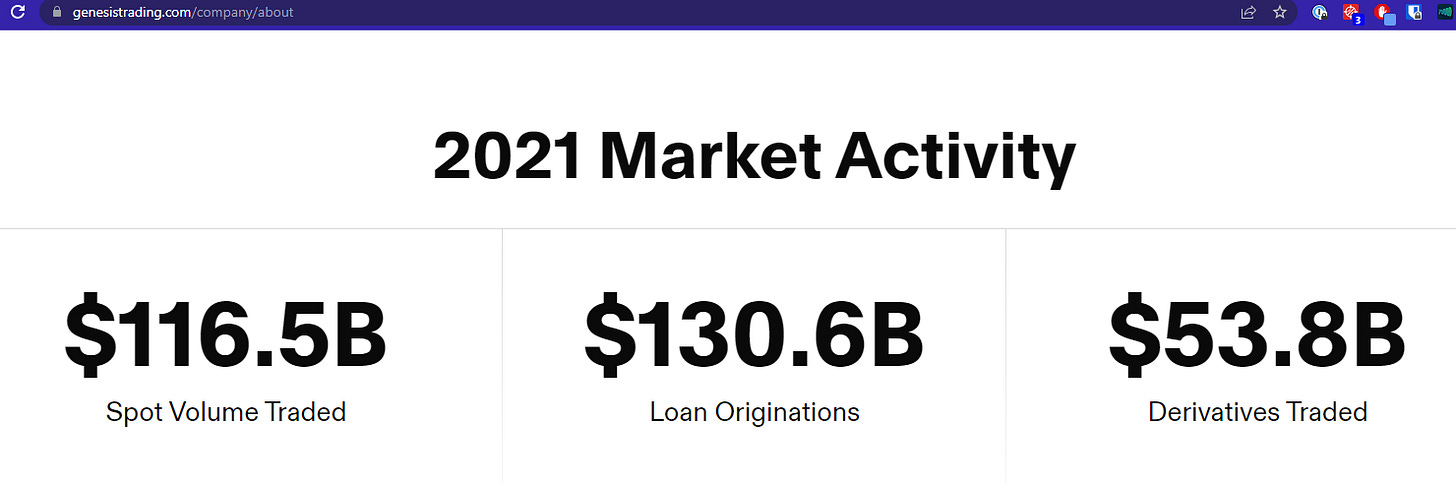

Other notable stats that DCG brags about on their own website: