Arbitrum ($ARB) AIP-1 Drama: Chicken, Egg and Ratification

Crypto twitter has been on fire this weekend with strong reactions to AIP-1 from the Arbitrum foundation. So what happened exactly?

Overview

AIP-1, Arbitrum's first governance proposal, generated significant outcries in the crypto community. The Foundation acknowledges communication could have been clearer and is working to improve.

Creating a DAO involves a "chicken and egg" problem, requiring decisions on parameters and the Foundation's setup. AIP-1 is a ratification of the initial setup of the Arbitrum DAO and the Foundation.

The token distribution to the Arbitrum Foundation is comparable to peer projects and seeks community ratification. The Foundation needs a token budget to fulfill its mission and engage with entities that require confidentiality.

The Foundation serves as a steward for the DAO and Arbitrum ecosystem, with the DAO holding governance authority over the Foundation. Communication around AIP-1 could have been clearer, and the Foundation is working with service providers to better manage governance processes.

Arbitrum is calling it a chicken and egg problem.

Do you agree?

In my view, the issue with this situation lies in the discrepancy between the language they currently employ and the phrasing found in the original proposal. This creates additional "wiggle room" and sets a concerning precedent.

Here is a direct quote from the Arbitrum Foundation forum:

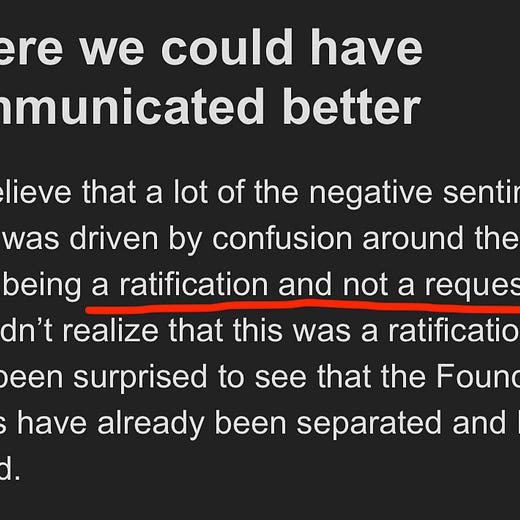

“a ratification of the initial setup of both the Arbitrum DAO and the Foundation that has been created to serve the DAO; this was spelled out at the end of AIP-1 in the section “Steps to Implement”, but it should have been made clear earlier on.”

Referring to "Steps to Implement" is already problematic, as there should have been a section using past tense to describe actions already taken. This might have improved communication regarding the ratification; however, they seem to deflect responsibility by implying that the information was there, but overlooked. The proposal's language hints at future plans without explicitly mentioning past actions already executed in AIP-1.

Community Reactions (BEFORE the Arbitrum Statement)

Arbitrum full statement post reactions here.

Can this have more serious consequences?

The thread lord Adam Cochran seems to think so. This is also where I got the idea to write this piece so shoutout to him.

Legal and Social Consequences of Centralized Governance in L2 Crypto Networks

Importance of decentralized governance in L2 networks As the cryptocurrency industry continues to grow, Layer 2 (L2) networks have emerged as a critical solution for addressing scalability issues in blockchain technology. Decentralized governance plays a crucial role in maintaining the trust and security of these networks, ensuring that no single entity can manipulate the system.

Dangers of centralization in governance However, centralized governance poses significant legal and social risks for L2 networks, potentially undermining their core value propositions and exposing them to regulatory scrutiny. This article will explore the consequences of centralized governance in L2 networks, with a focus on the recent developments surrounding Arbitrum.

Risks of Centralized Sequencers and Governance

Definition of a money transmitter In the United States, money transmitters are subject to specific regulations under both federal and state laws. Generally, any system that takes deposits of value, holds them on behalf of users, is centralized, and allows transfers, may qualify as a money transmitter in some states.

Legal consequences for L2 networks with centralized governance L2 networks with centralized governance structures may be at risk of being classified as money transmitters, exposing them to regulatory scrutiny and potential legal consequences.

Arbitrum's recent decision and its implications Arbitrum, an L2 network, recently made a controversial decision that undermined its decentralized governance structure, demonstrating that a single centralized party can make unilateral decisions with significant implications. This has raised questions about the network's legal standing and the long-term viability of its governance model.

Three Pillars of Decentralization for L2 Networks

The first is key signing as custody. One aspect of decentralization in L2 networks involves key signing as custody, ensuring that control over digital assets remains distributed among network participants.

Second is decentralized technology, another crucial component of decentralization is the underlying technology, which should consist of a distributed network of nodes and validators to maintain consensus and validate transactions.

And last but not least in the slightest, decentralized governance. Decentralized governance is essential for maintaining the integrity and autonomy of L2 networks, allowing users to participate in decision-making processes and ensuring that no single party can exert undue influence over the system.

All three pillars of decentralization are crucial for the legal and operational stability of L2 networks. Arbitrum's recent actions have highlighted the importance of these pillars and the consequences of failing to maintain them.

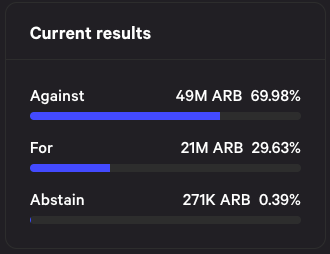

Arbitrum's recent decisions have set a worrying precedent for future actions within the network, demonstrating that centralized entities can effectively overrule or ignore governance votes, undermining the value of governance tokens.

This development has called into question the true value of governance tokens, as their utility appears to be no more significant than that of a simple Twitter poll.

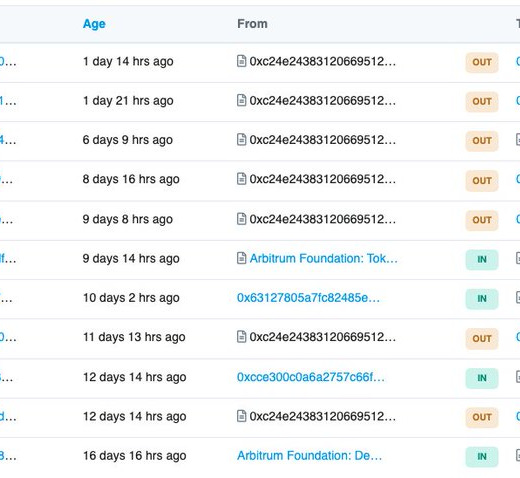

Arbitrum's actions have also raised concerns about potential legal liabilities, particularly with regard to misrepresenting users' voting rights and the resulting impact on token value.

Adam mentioned the EtherDelta case against the SEC and this totally brought back some hidden memories. The EtherDelta vs SEC highlighted that merely having decentralized key signing is not sufficient to claim a service is decentralized. This has implications for L2 networks relying solely on key signing for their decentralization claims.

This case illustrates the potential legal risks for L2 networks that fail to maintain a robust decentralized governance structure, potentially exposing them to regulatory scrutiny and consequences.

Increased Risk for Other L2 Networks

Arbitrum's situation highlights the importance of having a binding governance system in place for L2 networks. Without a solid framework, the entire industry is at risk of being subjected to regulatory scrutiny, which could hinder innovation and growth.

Arbitrum's case has raised awareness of governance vulnerabilities in the industry, emphasizing the need for L2 networks to establish clear, transparent, and enforceable governance processes to ensure long-term success and legal compliance.

Recommended Actions for L2 Networks

L2 networks should prioritize the development and implementation of decentralized sequencers and infrastructure to minimize their exposure to legal risks and ensure that they remain compliant with regulations.

To further enhance their governance structures, L2 networks should explore the possibility of creating binding-by-code governance systems, ensuring that decisions made within the network are automatically enforced without the need for centralized oversight.

Networks must also demonstrate a commitment to adhering to the outcomes of governance votes, strengthening the legitimacy of their decision-making processes and fostering trust among their users.

L2 networks without a token ready for prime-time should consider forming a consortium of partners to run sequencers or provers, ensuring that no single party has excessive control over the network's operations.

Conclusion

The recent developments surrounding Arbitrum have underscored the urgent need for L2 networks to address the risks associated with centralized governance. Failing to do so could jeopardize their legal standing and undermine the trust of their users.

As the cryptocurrency industry continues to evolve, it is crucial for L2 networks to remain mindful of the legal and social implications of their governance structures. By prioritizing decentralization and fostering transparent decision-making processes, these networks can ensure their long-term success and maintain the trust of their users.

Other Reading On This Topic:

Arbitrum Promises To Reconsider Proposal AIP-1 After 82.62% Votes Against

Arbitrum Foundation Sold ARB Tokens Ahead of 'Ratification' Vote; ARB Falls